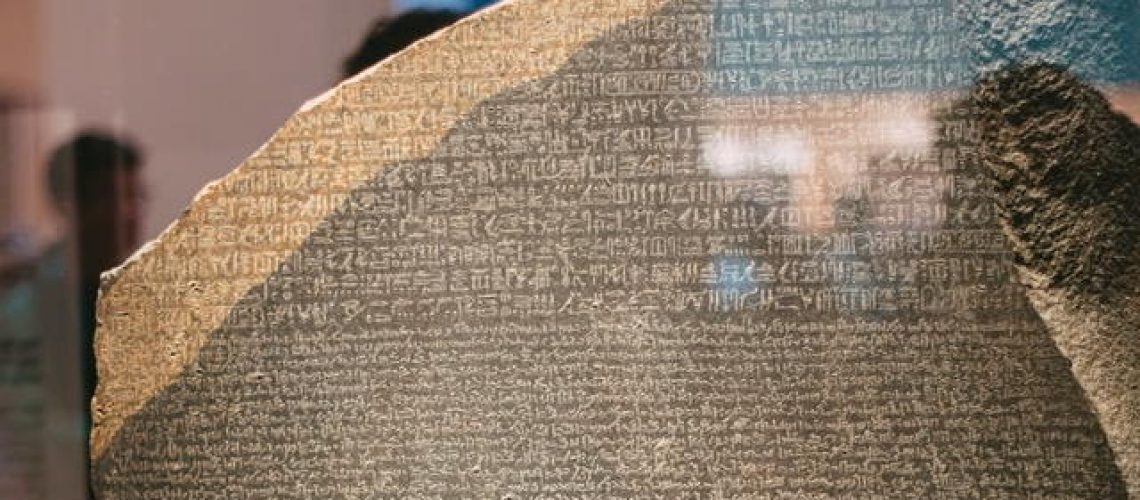

Since the dawn of time taxation has led to business records. Perhaps the oldest tax record is a clay tablet which is about 8,000 years old and comes from what is now Iraq. The Incas had a tax recording system based around knots in ropes. The Egyptian Pharoahs had a recording system. The Rosetta Stone is actually an announcement about new tax laws! … and of course we are all aware of the saying ‘nothing in life is as certain as death and taxes’.

The latest chapter in the UK’s system of taxation is that even the smallest of businesses (defined as more than £10,000pa sales income) will need to have a proper digital accounting system. The taxman’s Making Tax Digital (MTD) project started with legislation in 2017 and, so far, has only affected VAT registered businesses with sales turnover over £85kpa. But change is coming.

So what changes are coming?

1) From April 2022 all VAT registered businesses are within MTD for VAT. Which means they have to report their VAT returns computer to computer – ie use digital software.

2) From April 2023 self-employed businesses and landlords with sales over £10,000 will be within MTD for income tax. This means they will be required to do 5 tax returns per year. Four of these tax returns will be computer to computer returns, ie can only be done using a digital software. The fifth tax return will be a final business income declaration, ie similar to and replacing the current tax return.

3) Limited companies will eventually be required to do MTD for corporation tax. This will require limited companies to use a digital accounting system and do 5 tax returns per year, four of which can only be done via your digital accounting system.

Which means, the answer to the changes is to use a digital accounting software system if you aren’t already doing so. What’s more, now is the time to change and start using such a system so that it is bedded in, and you know what you are doing, ready for the new rules.

You will be forgiven for thinking this is another annoying regulation – but this is in fact a change that we should welcome! Not because we need to get a software app (although they can be intriguing!), but because using a proper accounting system will make keeping your business records simpler, easier and better. Using a proper system will mean that things shouldn’t get forgotten or missed off, will help to make sure that you do keep proper records, and that you claim all of your expenditure.

But the biggest reason is actually that better records are better for your business, because they give you proper information as you go through the year, to help you to make business decisions. Better information=better decisions. Better decisions normally means better business and better business means a better life.

There are several different digital accounting systems out there – and the one we recommend is Xero. Follow this link to find out a bit more about the benefits of Xero

Let us help you make that move to better accounting; let us show you first-hand how Xero can benefit your business and the difference it can make. Email us now at [email protected] to find out more.