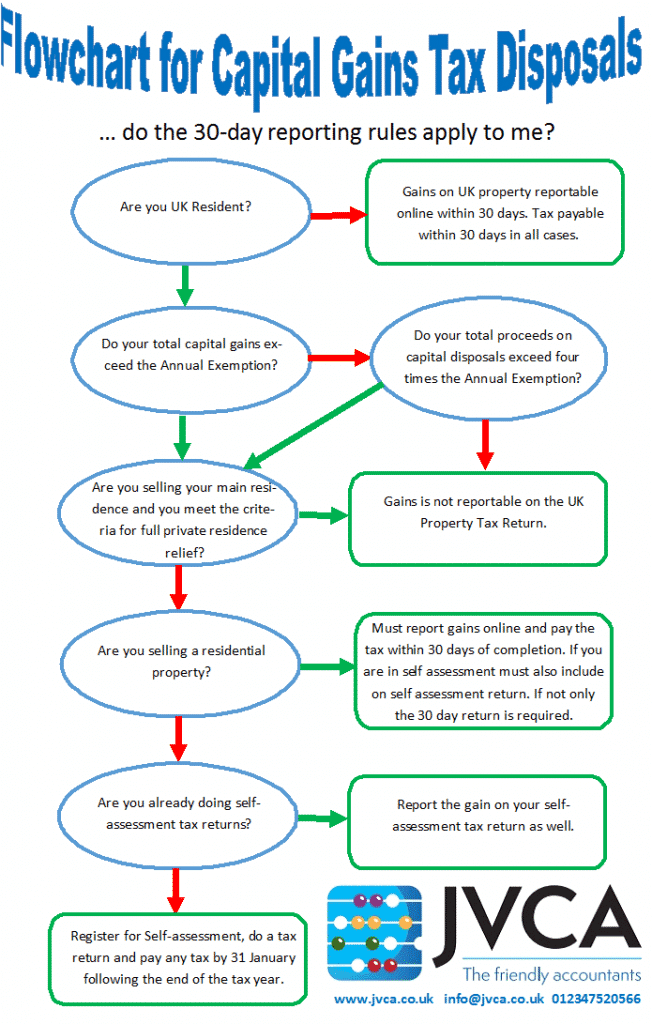

There can be some confusion over whether the 60-day CGT reporting rule applies in your particular circumstances. I’ve put together this flow chart, which should help you to find your path through the fog. After all, how to work out if you need to pay tax on selling your house?

This might come under the heading of boring but important information – because if you sell a property in the UK then you may well have to do a special UK Property Tax Return within 60 days of the sale. and pay any relevant tax at the same time! This used to be a 30 day deadline and this has since been extended to be a 60 day deadline. This flowchart should make it easy for you to work out if you need to do this special tax return.

Everybody who sells a second house needs to be aware of this as you don’t want to get caught out by the tax rules.

Note that the deadline was extended from 30 days to 60 days in October 2021 – but even so this is not a long period to get the information and work through HMRC’s slightly complex process for reporting your capital gains.

Need help with your CGT? Just get in touch at [email protected]